Global Thin Film Solar Cell Industry: Key Statistics and Insights in 2024-2032

Summary:

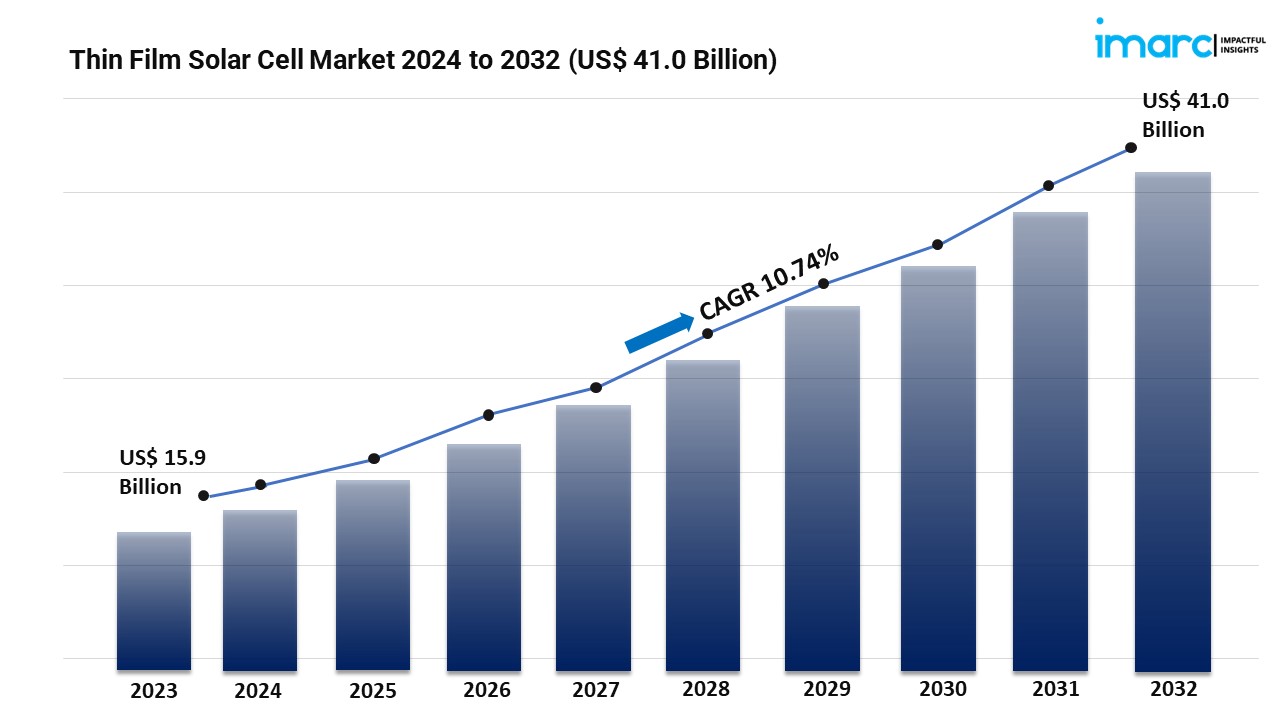

- The global thin film solar cell market size reached USD 15.9 Billion in 2023.

- The market is expected to reach USD 41.0 Billion by 2032, exhibiting a growth rate (CAGR) of 10.74% during 2024-2032.

- Asia Pacific leads the market, accounting for the largest thin film solar cell market share.

- Cadmium telluride accounts for the majority of the market share in the type segment as it offers a higher efficiency than traditional silicon-based solar cells.

- On-grid holds the largest share in the thin film solar cell industry.

- Utility remains a dominant segment in the market due to the increasing focus on enabling seamless integration with existing infrastructure.

- The rising focus on cost-efficiency is a primary driver of the thin film solar cell market.

- The increasing need for flexible and versatile solutions and favorable government initiatives are reshaping the thin film solar cell market.

Industry Trends and Drivers:

- Growing Focus on Cost-Efficiency:

One of the most significant drivers for thin film solar cells is their cost-effectiveness. The production of these cells requires fewer raw materials as compared to traditional crystalline silicon-based solar panels, which reduces manufacturing costs. Thin film solar cells can be produced through high-throughput manufacturing processes like roll-to-roll, allowing for mass production at lower costs. Additionally, these cells perform better in low-light conditions, providing a competitive advantage in regions with less sunlight. The combination of lower material costs and higher energy yield in diverse lighting conditions makes thin film solar technology appealing for large-scale solar installations, including commercial and utility projects. This cost advantage is increasing their adoption in various sectors, helping them compete more effectively with other renewable energy sources.

- Rising Need for Flexible and Versatile Solutions:

Thin film solar cells offer unique advantages due to their flexibility and lightweight nature. Unlike conventional rigid solar panels, these cells can be integrated into various surfaces, including curved structures, buildings, and portable devices. Their ability to conform to different shapes makes them ideal for innovative applications like building-integrated photovoltaics (BIPV), where solar cells are embedded directly into construction materials, such as windows and roofs. Additionally, their lightweight composition makes them suitable for transportation, portable electronics, and off-grid power generation. This versatility opens new market opportunities, expanding the use of solar energy beyond traditional installations. Industries are increasingly focusing on adopting renewable energy solutions.

- Favorable Government Initiatives:

Governing agencies of various countries are implementing favorable regulations, subsidies, and tax credits to encourage the adoption of renewable energy technologies. These incentives make solar energy projects more financially viable, reducing the initial capital investment required for installation. In line with this, governing authorities are setting ambitious targets to reduce carbon emissions, pushing for increased reliance on renewable sources like solar energy. For example, the European Union’s Renewable Energy Directive and the United States’ Investment Tax Credit (ITC) are implementing policy frameworks to promote the development of thin film solar technology, accelerating its adoption in both residential and commercial sectors.

Request for a sample copy of this report: https://www.imarcgroup.com/thin-film-solar-cell-market/requestsample

Thin Film Solar Cell Market Report Segmentation:

Breakup By Type:

- Cadmium Telluride

- Amorphous Thin-Film Silicon

- Copper Indium Gallium Selenide

- Microcrystalline Tandem Cells

- Thin-Film Polycrystalline Silicon

- Others

Cadmium telluride accounts for the majority of shares as it offers a high efficiency than traditional silicon-based solar cells.

Breakup By Installation:

- On-Grid

- Off-Grid

On-grid dominates the market on account of its ability to lower electricity bills.

Breakup By End User:

- Residential

- Commercial

- Utility

Utility represents the majority of shares due to the rising focus on enabling seamless integration with existing infrastructure.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position owing to a large market for thin film solar cell driven by favorable government initiatives.

Top Thin Film Solar Cell Market Leaders: The thin film solar cell market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Ascent Solar Technologies Inc.

- First Solar Inc.

- Flisom

- Hanergy Thin Film Power EME B.V.

- Kaneka Corporation

- Miasole (Hanergy Holding Group Ltd.)

- Oxford Photovoltaics Limited

- Trony Solar Holdings Company Limited

- Wuxi Suntech Power Co. Ltd.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163